The aim of this review is to provide a graphic demonstration of true factors of economic growth in the Russian Federation in 2000-2008. It will allow us to understand, why the financial crisis in Russia begun from September, 2008, firstly, was inevitable for our country, secondly, related to the world financial crisis indirectly and, thirdly, did not even come to an end. On the contrary, the crisis is deepening now. All diagrams in this review are based on the official statistics published by the Central Bank of the Russian Federation, the Federal Treasury and the Federal Statistic Service.

As follows from diagrams above, growth of GDP and international reserves of the Russian Federation in 2000-2008 occurred synchronously. It means that both indicators are directly proportional to the same factors. To identify these factors it would be reasonable to familiarize with indicators of export of crude oil, oil products and natural gas from the Russian Federation in 2000-2009.

The analysis of diagrams above forces us to come to following conclusions:

1. Growth rates of GDP and international reserves of the Russian Federation are directly proportional to export prices for hydrocarbon raw materials, and a role of other factors in the GDP formation is secondary;

2. Profit from the export of hydrocarbon raw materials has sharply increased in 2004-2008 only because of the speculative rise in prices at stock exchanges around the world. It is necessary to underline, that in 2004-2008 export of crude oil and natural gas from the Russian Federation did not increase, but even reduced because of the oil and gas production reduction and neglect of geological survey. As appears from above, it is impossible to give the Government and top management of oil and gas companies the credit for receiving of the superprofit. Also the GDP growth rate in 2004-2008 was not a result of economic policy of the Government. It means that the Government owed its success in 2004-2008 to a favorable economic conjuncture abroad.

Dramatic deterioration of the external economic conjuncture has consistently led since September, 2008 to reduction of profit from the export of Russian hydrocarbon raw materials, collapse of stock markets’ indexes, ruble devaluation and peculation of one third of international reserves of the Russian Federation, unprecedented capital flight abroad, staff reductions in private sector and unemployment growth. As it has turned out, the Government was incapable of prevention of such further developments and practically confirmed that it was a secondary factor of economic policy.

Corporate top management in Russia demonstrated an unbelievable incompetence when it was recklessly increasing the private sector external debt in 2004-2008. The external debt of the private sector on the diagram below is not shown separately from external debt of the public sector specially to underline that the Government is answerable for its decision to reduce an external public debt faster and victoriously inform mass media about it, but at the same time, to shift new much more sizeable external debt to a private sector.

Note should be taken that aggregate of external debts of the Russian Federation practically did not change in 2008-2010 though there were very serious payments during this period. Thus, in October, 2008 - April, 2009 the private sector paid not less than $ 101 billion. During October, 2009 - October, 2010 it must pay $ 134,2 billion. In October, 2010 - October, 2011 the private sector will be faced with payment at the rate about $ 90 billion. After October, 2011 it should return $ 294,4 billion. All these are not including payments which can be demanded by creditors actually at any time - $ 22,4 billion are payable on demand and $ 40 billion have an uncertain maturity of the loan. We don’t see how borrowers plan to pay off their debts in conditions of the financial crisis.

As is obvious from the diagram above, incomes of the federal budget were sharply increasing in 2004-2008 because of the favorable external economic conjuncture. It is necessary to pay attention to the following:

1. Incomes of the federal budget 2009 were equal to incomes of the budget 2006; however expenses of the budget 2009 were at the level of 2008. We see similar situation with the budget 2010 - its incomes are planned at level even below the level of 2006, but expenses remained at level of 2008 or 2009;

2. Unavailability of the Government to a cut in expenditure has led to the 2009 budget deficit of $ 73.3 billion. Estimated 2010 budget deficit of $ 87.1 billion is even more than 2009 budget deficit;

3. A reason why the Government has preferred a huge budget deficit to a cut in expenditure is a mortal fear of a social tension growth. The point is that there had been reached a tacit understanding between the state and the society. In accordance with it the current Russian regime guaranteed that the society will get possibility to raise the living standard in exchange for refusal of the basic civil and political rights. However, the regime is not already able to support such guarantees because of the systemic crisis, but at the same time, it doesn’t want to return the basic civil and political rights to the people. It is obvious, that such situation cannot go on forever. It shall come to an end when sources of the budget deficit financing shall run out;

4. The budget deficit was compensated for in 2009 and will be compensated for in 2010 only by savings from hydrocarbon raw materials export in 2004-2008. The speed of exhaustion of these savings is inversely proportional to the export prices for hydrocarbon raw materials. The speculative rise in prices for crude oil at stock exchanges around the world since the end of the 2nd quarter of 2009 had been caused only by the liquidity flooding at the world stock markets. It happened as a result of urgent economic support measures taken by G-20 which delayed the payback time exactly for their lifetime period.

As the diagram above indicates, the federal budget revenue since 2004 has increased only because of unrehearsed oil and gas incomes. These incomes are formed of the tax on mining operations with crude oil, natural gas and gas condensate and the export duties on natural gas, crude oil and oil products.

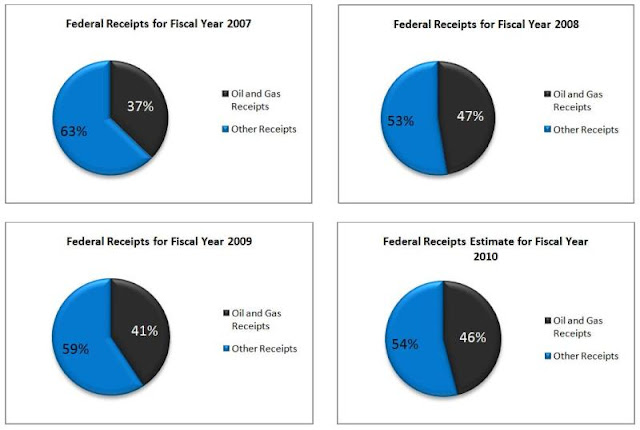

It is necessary to pay attention, that oil and gas incomes were not detailed in the federal budget during 1999-2003. It means that in 1999-2003 percentage of oil and gas incomes in federal receipts were even lower, than that is indicated at circular graphs. Oil and gas incomes for 2004-2010 are calculated by summation of budget receipts from the tax on mining operations with hydrocarbon raw materials, the export duties on crude oil, oil products and natural gas. Oil and gas incomes for 1999-2003 are calculated by assembling of excises on natural gas, oil and stable gas condensate, royalties, the tax on mining operations, contributions for reproduction of a raw-material base and export duties.

As follows from circular graphs above, the dependence of federal receipts on oil and gas incomes has extremely increased since 2004, and even now, in the 2010 federal budget is planned at inadmissible level. It means that the Government does not even try to diversify sources of incomes and obstinately refuses to consider the future. It expects returning of the "pre-crisis" level of the export prices for hydrocarbon raw materials. These expectations have partly proved their value since the second half of 2009, but the Government does not realize that it is only a temporary respite.

Capital flight in 2008-2009 struck the Government with terror. Monstrous size of the capital flight underlines the private sector’s absence of belief in the Government’s ability to cope with financial crisis or at least to stop its deepening.

Diagrams below are given only to show even more clearly the dependence of basic economic indicators on the export prices for oil and gas.

It is necessary to pay attention at logical dependence of the prices for dwellings in Moscow on the export prices for hydrocarbon raw materials. The indicator given above is very important to understand that such dependence at the Moscow real estate market has overstepped the limits of common sense. The matter is that Moscow was among the top three of the most expensive cities in the world in 2008 according to the international consulting company Global Property Guide. Certainly, Monaco was in the lead but Moscow left far behind itself London, New York and Tokyo. However Moscow has fallen on 6th place in 2009, but even now it leaves behind itself such cities as Singapore, Paris and Geneva.

Prices for dwellings in Moscow have not fallen as strongly as it would be logical for expecting after the beginning of the crisis. The problem is that the market of Moscow real estate is affected by oligopoly and even the Federal Antimonopoly Service is incapable to combat it. This oligopoly allows keeping prices at that level which has nothing in common with responsible demand. Such situation is typical for a lot of markets and sectors of Russian economy, so it cannot be considered as a free market one.

As to other diagrams above, the beginning of the crisis in September, 2008 is clearly shown there when all indicators synchronously started to fall. In such conditions the level of proficiency of officials of economic block of the Government gets special value because they should be able to see the situation in proper perspective and to make accurate forecasts. Have Russian officials shown us such professional skills before the crisis and after its beginning? Have they proved their conformity to state posts held by them? To assess this, it is necessary to make good quotations objectively characterizing the level of readiness of state officials to struggle against crisis.

29th December, 2007. Aleksey Kudrin, Deputy Prime Minister and Finance Minister: «There shall not be any crises, defaults, devaluations and unrests which would prevent development of our economy».

9th February, 2008. Aleksey Kudrin, Deputy Prime Minister and Finance Minister: «Price for oil will decrease, but insignificantly… We are ready to it, and the new price will not affect the Russian economic growth rate… The economic growth rate slowdown around the world will not practically affect the economic growth of Russia at all».

14th February, 2008. Vladimir Putin, the President of the Russian Federation: «Moreover, the Russian economy has to a certain extent become something of a haven for international capital. We offer a stable economic and political situation and this attracts capital».

19th September, 2008. Alexander Zhukov, Deputy Prime Minister: «I think that we are not threatened with ruble devaluation today and ruble will be supported confidently and fail-safely because the Central Bank has very large international reserves for this purpose. No one should be concerned about it».

22nd October, 2008. Igor Shuvalov, First Deputy Prime Minister: «We do not have any plans [on devaluation]. We consider that devaluation would be harmful».

25th October, 2008. Aleksey Uljukaev, First Deputy Head of the Central Bank of the Russian Federation: «All fundamental circumstances of our economy are quite good, and it doesn’t follow from the fact of existence of the world financial crisis that ruble should be devaluated».

29th October, 2008. Dmitry Medvedev, the President of the Russian Federation: «I’ve kept all my bank accounts. I didn’t transfer money and didn’t convert rubles to dollars... I’m sure that my personal savings are in no danger as well as savings of other Russian depositors».

10th November, 2008. Sergey Ignatyev, Head of the Central Bank of the Russian Federation: «I don’t exclude an increase of flexibility of the ruble exchange rate, maybe, in present conditions with some tendency of weakening of ruble in relation to foreign currencies».

19th November, 2008. Arcady Dvorkovich, Adviser to the President of the Russian Federation: «There are no grounds of devaluation even in the time of low prices for oil. There shall not be devaluation in spite of wish of some people for it».

19th November, 2008. Aleksey Kudrin, Deputy Prime Minister and Finance Minister: «If we’ll take into account the experience of the default and the devaluation in 1998, the amount of international reserves which Russia has saved during last several years, allows us to say that the foundations of the stable macroeconomics and the national currency rate are laid down».

20th November, 2008. Vladimir Putin, the Prime Minister of the Russian Federation: «We’ve saved up considerable financial reserves. They’ll give us freedom for maneuver; allow keeping macroeconomic stability, curb inflation and prevent sharp change of ruble exchange rate».

What follows from the above? First of all, that an economist is not someone who has a diploma, academic degree or a state post. Everyone is able to receive them in the modern world, and then use them as a cover for his lack of talent. Every person without talent may excuse for us: «I failed to take into account such-and-such factors because nobody could do it in those conditions and at that time».

Maybe in 2009 the Government started at least to change the commodity structure of export of Russia in order to reduce economic dependence on raw materials export? Let’s compare the commodity structure of the foreign trade turnover in 2008 with 2009 one.

It's impossible to find a difference between the commodity structure of the Russian export in 2008 and 2009. Proportions are equally awful for Russia and show that the Government did not lift a finger to diversify the economy even after the beginning of the financial crisis.

Such structure of import demonstrates the complete breakdown of the once-powerful engineering industry, chemical industry and agriculture. This undermines the economy and makes the country vulnerable at any time.

As seen, the export of various raw materials from Russia in 2008-2009 amounted to 80% of total exports. Perhaps, such structure the foreign trade turnover is unusual for a country of the G8. On the contrary, it is typical for an African country like Nigeria or Congo. Such situation will not lead Russia to anything good.

By the way, according to customs statistics, Russia\'s foreign trade in 2009 amounted to 469 billion U.S. dollars and was 36.2 percent down from the previous year. The balance of trade turned positive in the amount of 134.3 billion U.S. dollars. It was 66.2 billion dollars lower than in 2008.

The main conclusion of this Review suggests itself and consists of the following. Financial crisis in Russia has intrinsic sources, and the international financial crisis only brought closer the judgment day for the Russian regime. Internal financial crisis will go deep into the economy. The Government proved its unavailability to do its own work professionally. Such situation is fraught with serious consequences like worsening of living standards and causing of social tension. If the Government will not dare to soften a political climate in Russia, the country will be threatened again with danger of rebellions, armed conflicts and disintegration.

Комментариев нет:

Отправить комментарий